Understanding trading – basic knowledge for sustainable success in trading

Recently, trading, often referred to as trading, has become increasingly popular among the younger generation. Many dream of rapidly building wealth through trading, but only a small group succeed in consistently making profits.

If you want to establish yourself as a successful trader, you have to show persistence, patience and self-discipline. But what should beginners know about trading? How do you choose the right method and trading software?

In this article, we look at what lies behind trading, what qualities characterise a successful trader and what ideas you should have about trading.

What does trading mean? Buying when it is cheap and selling when the price goes up?

Trading, in the context of trading, refers to the short to medium term buying and selling of assets in a liquid market. The main objective of a trader is to buy assets such as shares, foreign exchange or commodities at a low price and sell them at a higher price.

An essential aspect for success in trading is the ratio of opportunity to risk. To make profits, traders should try to increase their returns while minimising their potential losses.

Although this principle of trading sounds simple, its application in reality is challenging. Losses are inevitable in trading. There is always risk involved. Moreover, market prices are unpredictable and there is no guarantee of positive results. Traders strive to make profits based on probabilities in the market. But doesn’t an investor also pursue this goal? Where are the boundaries between short-term trading and long-term investment?

Trading compared to long-term investment: the essential differences

While traders aim for short-term gains, long-term investors focus on the steady growth of their capital. Traders invest more time, monitor markets closely and react quickly, while buy-and-hold investors take a more relaxed approach.

Traders aim for fast capital turnover

Traders strive to grow their capital faster. By constantly reinvesting small profits, they try to maximise the compound interest effect.

Their focus is on short-term market opportunities. Therefore, capital is constantly “rotated”, buying and selling assets to take advantage of short-term price fluctuations.

Interestingly, a study shows that the average holding period of equities is steadily decreasing. In 2022, it was observed that shares are held for less than a year on average. Unlike traditional investors, traders have more transactions. Quick profit taking and limiting losses are essential in trading. Large market volatilities cannot simply be ignored if the goal is to grow capital quickly.

Investors rely on passive income

While traders are captivated by the markets on a daily basis, investors strive to make their money work efficiently for them while minimising effort.

Each investor sets the level of investment according to their individual goals. It is possible to provide for retirement through regular, smaller contributions to ETFs or to move closer to financial independence through larger investments.

Among younger investors, the FIRE (Financial Independence, Retire Early) movement is gaining popularity, with some going as far as frugalism to reduce or leave the profession altogether before the statutory retirement age.

There are grey areas between trading and investing

There is no clear line between traders and investors. While Warren Buffet prefers to hold his stocks permanently, there are traders who hold their positions for seconds or minutes only.

But how can traders decide when to open or close a position in such a short time? In the following, we will take a closer look at the different trading strategies.

Finding the way to the ideal trading strategy

To be successful in trading, a solid strategy is essential. This strategy provides clear rules for when to open, increase, maintain, decrease or close positions. The more precise the rules and strategies, the more successful the trading.

Why a trading strategy is so important

There are two main reasons why an effective trading strategy is crucial. First, personal emotions can lead us to make decisions that jeopardise success. Second, a well-designed strategy should allow one to systematically make profits based on mathematical probabilities.

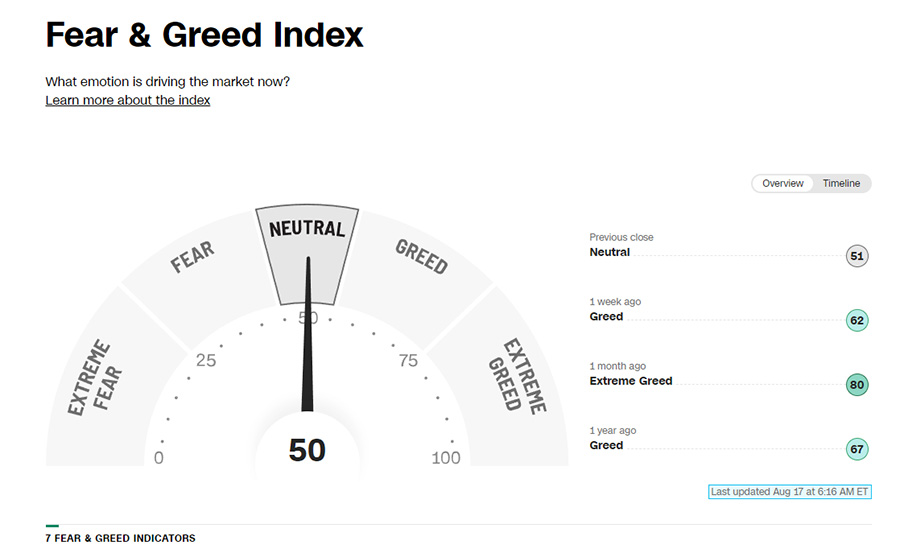

Our decision-making is often influenced by emotions, especially when it comes to money. Here, fear and greed dominate. Based on this, the Fear & Greed Index was created, which reflects market sentiment.

Everyone who embarks on the trading adventure wants to make profits. But often the intense desire for quick profits becomes the Achilles heel of many traders. This impetuous greed can cloud judgement and make it difficult to objectively evaluate the potential benefits and dangers of a trade.

The uneasy feeling of overlooking a potentially profitable market shift can lead to rash actions. This feeling, commonly known as FOMO, can cause traders to act rashly and try to enter a market that is already moving.

The foundation of a successful trader is a well-thought-out trading strategy that helps make informed decisions in any market situation, avoiding emotional blunders when buying or selling.

What approaches do traders take to their strategies?

There are different approaches to trading. Here is a brief overview of the most common trading strategies:

I) Technical chart analysis in trading

The vast majority of trading methods are based on technical analysis of price charts. Traders analyse chart patterns, examine candlestick formations and identify support and resistance lines to predict future price movements. Elements such as moving averages and various indicators help verify these predictions. Based on these analyses, traders can define clear entry and exit strategies.

II) Trend following and momentum trading

Traders who rely on trends and momentum look specifically for pronounced market trends and position themselves according to this direction. For example, they might bet on persistently rising prices of assets that are already showing an upward movement. This strategy is particularly suitable in clear bull or bear markets.

III) Pullback and Rebound Trading

These are strategies that target a price correction or trend reversal. With pullbacks, traders try to precisely hit the turning point of a movement. This approach is particularly suitable in phases in which the market is trending sideways and no clear trends can be identified.

IV) Fundamental analysis in trading

While many traders rely on technical analysis, others incorporate fundamental data into their strategies. Quantitative aspects such as company growth or profitability could play a role here. But qualitative factors such as the management of a company or political developments can also be taken into account. Although purely fundamental trading approaches are rare, some traders use this type of analysis to complement technical data.

V) Long vs. short trading

In trading, positions can be opened that bet on rising (long) or falling (short) prices. While a long position bets on rising prices, a short position speculates on falling prices. Short trading, however, carries a higher risk due to the potentially unlimited risk of loss and therefore requires extensive experience and strict risk management.

Different trading strategies based on holding period

There are different approaches to trading depending on the length of time a position is held: Day Trading, Swing Trading and Position Trading.

- Day trading: Day traders open and close their positions within a single trading day. They usually hold their positions for only a few hours. Their main focus is on technical indicators and patterns to make decisions.

- Scalp Trading: Scalp trading refers to trading where positions are held for a very short time – minutes to seconds. Thanks to modern technologies, scalping is nowadays often supported or even automated by algorithms and artificial intelligence.

- Swing trading and position trading: Swing traders try to take advantage of short-term market movements and hold their positions for days to weeks. In contrast, position traders often hold their positions for months. Because of this longer holding period, fundamental analysis is more important in position trading.

What is the optimal trading strategy?

In order to determine whether a trading strategy is effective, historical tests, so-called back-tests, are often carried out. Tools and software that can be used for back testing include:

- Portfolio Builder from TraderFox

- TradingView

An often overlooked aspect is that the chosen strategy must also fit the trader’s lifestyle and daily routine. Only those who follow their strategy consistently and with discipline have a chance of long-term success in trading.

But how does one proceed once one has decided on a certain approach? A decisive factor here is the selection of the assets with which the trader wants to trade.

What assets can traders trade?

After understanding the basics of trading and the goals of successful traders, the question is: what assets are available to traders?

Depending on the asset, there are different advantages and challenges that traders have to deal with. Here is an overview of the most common assets in trading:

- Forex Trading: Forex trading deals with the trading of currency pairs. For example, the performance of the euro against the US dollar can be traded, as well as more exotic currency pairs. The primary influencing factors are macroeconomic data and global economic developments. Due to the rather low volatility, many forex traders use high leverage.

- Stock trading: Stocks are one of the most frequently traded assets. Traders take advantage of the smallest price movements and often focus on growth stocks. Price movements can be influenced by fundamental events such as business figures or product news, with technical analysis being used for precise entries and exits.

- Crypto trading: Cryptocurrencies have gained in importance in recent years. Traders can trade the performance of individual cryptocurrencies against fiat currencies or other cryptos. Examples are Bitcoin to USD or Ethereum to Bitcoin. Cryptocurrencies are known for their high volatility, which means that high leverage is often not needed.

- Index trading: Stock indices, such as the S&P 500 or the DAX, are also popular trading objects. Here, traders focus less on individual companies and more on macroeconomic influences and overall trends.

- Commodity trading: Commodities such as gold, silver, oil or grain can be traded on the stock exchange using futures. These futures contracts are time-limited derivatives that track a specific commodity.

- CFD Trading: CFDs (Contracts for Difference) offer an alternative to futures and allow trading of price developments of various assets, such as shares, indices or cryptocurrencies. They are particularly popular among traders with smaller positions due to the low transaction costs.

After we have discussed the different trading assets, the question remains: where can they be traded? Below we present some platforms that are particularly suitable for beginners.

Trading platforms – where can you trade?

Choosing the right trading platform is crucial and depends heavily on the trader’s individual needs.

Here is an overview of five popular CFD brokers

1. Plus500: Plus500 is an internationally renowned platform that features a user-friendly interface and a wide range of tradable assets. With a tight spread and an intuitive app, it is particularly suitable for beginners. Plus500 Review

2. ActivTrades: ActivTrades offers a wide range of trading instruments and has a good reputation for customer service and educational resources. With a long-standing presence in the market, the broker has established itself as a reliable partner for many traders. ActivTrades Review

3. eToro: eToro is best known for its social trading. Here traders can copy the strategies of other traders or share their own trading strategies. With a wide range of assets and a community-centric approach, eToro is ideal for those who want to benefit from the knowledge of others.

4. Libertex: Libertex features transparent fee structures and a clear trading interface. With over 20 years of experience in the industry, the broker offers a solid platform for both beginners and experienced traders. Libertex Review

5. AvaTrade: AvaTrade is known for its advanced trading tools and wide range of educational resources. The platform offers a variety of trading tools and has a strong regulatory presence worldwide. AvaTrade Review

For a detailed evaluation and comprehensive comparison of this and other providers, we recommend consulting our trading provider comparison.

Opportunities and risks in trading

Trading is a double-edged sword that involves both opportunities and risks. An often quoted saying in the industry is: 90% of traders lose 90% of their capital within the first 90 days (the so-called 90-90-90 rule). Statistics show that up to 95% of all traders lose money. At the same time, trading attracts the attention of many with its potential profits.

Can you make a living from trading and how risky is it really?

Potential advantages of trading:

- Potential profitability: with enough start-up capital, a proven strategy and discipline, there is a chance to trade profitably.

- Personal development: trading can develop personal skills such as discipline and perseverance and forces one to deal with one’s own psyche.

- Market knowledge: Traders are often well informed about current trends and market developments, as they are constantly exposed to news and changes.

- Accessibility: Nowadays, access to knowledge about trading strategies and platforms is easier than ever thanks to the internet.

Challenges and risks of trading:

- High loss rate: a large proportion of traders lose money, which is underpinned by the 90-90-90 rule.

- Misjudgements: The ease of entry into trading can lead to the misconception that it is easy.

- Financial dangers: Risking more money than you can afford to lose or trading on credit can land you in serious financial trouble.

- Emotional traps: Especially after a series of successes, it can be hard to stay disciplined and not trade cockily.

Trading is therefore not a no-brainer and requires not only knowledge and strategy, but above all good risk management and self-control.

FAQs

What exactly is trading and how does it work?

Trading is the short to medium-term buying and selling of assets in a liquid market, with the aim of buying at a lower price and selling at a higher price. The goal of traders is to maximise profits and minimise potential losses.

What are the main differences between trading and investing?

Trading typically involves a shorter time frame, buying and selling assets quickly to take advantage of short-term price movements. Investing, on the other hand, involves holding assets for the long term and letting them grow in value over time.

What trading strategies do professionals often use?

Professionals use a variety of strategies, including technical chart analysis, trend following, pullback and rebound trading, fundamental criteria analysis, and both short and long trading positions.

How can beginners start trading?

Beginners should start with understanding the basics of trading, develop a strategy and practice discipline. They should also choose a suitable trading platform and start with a small amount of capital to minimise risk.

What are the potential risks and rewards of trading in financial markets?

Although trading offers the opportunity for significant profits, it also carries risks. Many traders lose money, especially at the beginning. The key lies in a well thought-out strategy, discipline and effective risk management.

What assets can be traded on the market?

Various assets can be traded, including shares, indices, forex pairs, cryptocurrencies, commodities and derivatives such as CFDs.

How do I choose a suitable trading platform?

Choose a platform based on its reliability, user interface, available assets, fees and customer reviews. Some popular options are Plus500, ActivTrades, eToro, Libertex and AvaTrade.

What tips are essential for successful trading?

Success in trading requires a combination of discipline, a well-defined strategy, continuous learning and effective risk management.

How important is risk management in trading?

Risk management is crucial. Without it, traders can suffer significant losses. This includes setting stop-loss orders, risking only a small percentage of capital on a single trade and understanding market conditions.